Small business income tax offset

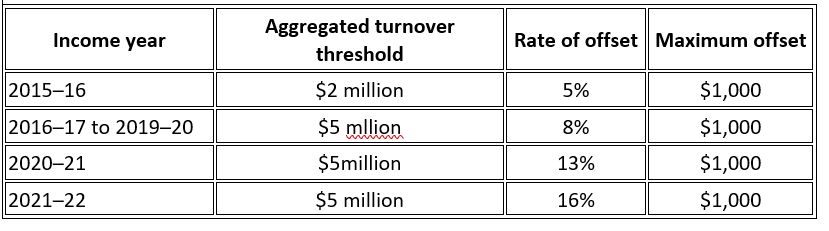

The small business income tax offset (also known as the unincorporated small business tax discount) can reduce the tax you pay by up to $1,000 each year.

The offset is worked out on the proportion of tax payable on your business income.

To be eligible for the offset, you must be carrying on a small business as a sole trader, or have a share of net small business income from a partnership or trust.

The small business must have an aggregated turnover of less than $5 million for the 2016-17 income year onwards .

Table: Progressive changes to the small business income tax offset

Your offset will be worked out based on the amount you show in your income tax return. These amounts are your:

- net small business income that you earned as a sole trader

- share of net small business income from a partnership of trust.

The Money Edge | Bundaberg

.png)

.png)

.png)