JobKeeper Extension

Much awaited ATO and Government announcements have been made this week regarding the JobKeeper extension that starts at the end of

September.

On Tuesday 15 September, Treasury registered the rules setting out the decline in turnover test for the extension of JobKeeper to 28 March 2021 and the new two-tiered payment rates.

On Wednesday 16 September, the Australian Tax Office revealed their guidelines around the extension.

Following we have provided an overview of changes made to the JobKeeper scheme.

Turnover Test

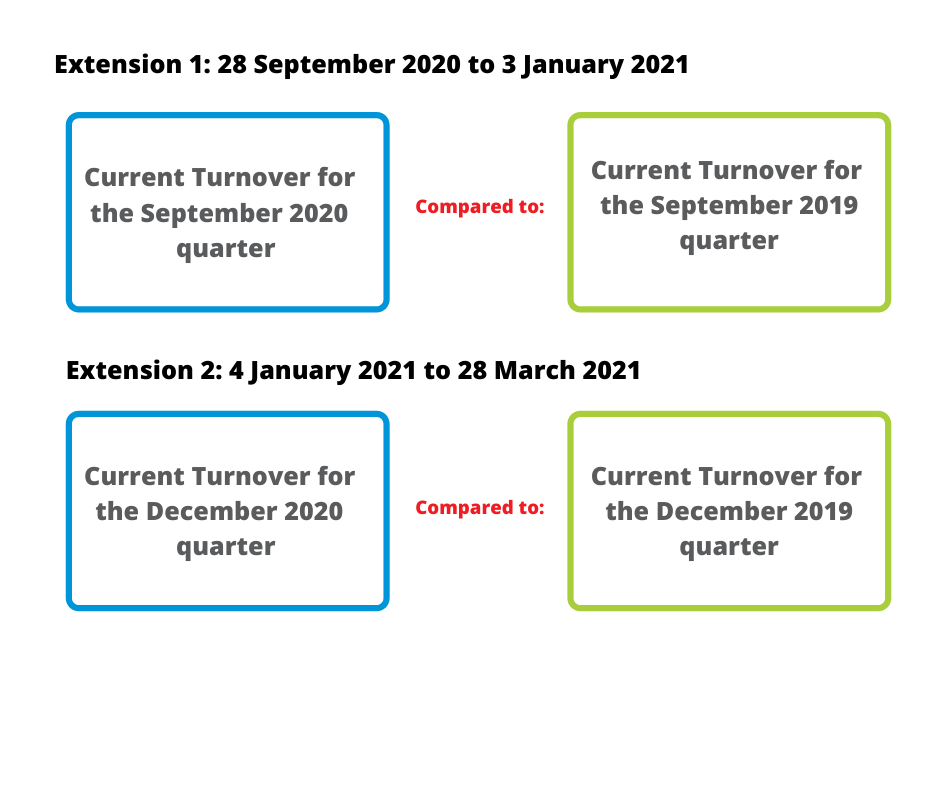

To be eligible for the first extension period between 28 September 2020 to 3 January 2021, businesses will need to satisfy the new actual decline in turnover test for the quarter ending 30 September 2020 compared to the quarter ending 30 September 2019. The September quarter, meaning July, August, and September.

To be eligible for the second extension period between 4 January 2021 and 28 March 2021, the actual decline in turnover test will need to be applied for the quarter ending 31 December 2020 compared to the 31 December 2019 quarter. The December quarter, meaning October, November, and December.

Treasury rules imply that businesses can qualify for JobKeeper for each extension period if they satisfy the turnover test for that quarter, even if they did not previously qualify.

Payment Rates

The same rules apply in that the employee must be receiving the gross fortnightly payment as to the rate that they are nominated.

The extension period that runs from 28 September 2020 to 3 January 2021 will allow eligible businesses with eligible employees who worked for 80 hours or more in the 28-day period before either 1 March 2020 or 1 July 2020 to receive $1,200 per fortnight. Businesses with eligible employees who worked less than 80 hours in the 28-day period before either 1 March 2020 or 1 July 2020 will receive $750.

For the period running from 4 January 2021 to 28 March 2021, the rate will drop to $1,000 per fortnight and $650 per fortnight.

Hours worked in the relevant period include actual ordinary hours worked and any hours the employee received paid leave, including annual,

long service, sick/carers, or paid absence for public holidays.

Businesses will be required to nominate which payment rate they claim for each of their eligible employees or a business participant to the

ATO. Within 7 days of notifying the ATO the employer will need to inform the employee of what rate has been applied.

The ATO has advised that for the JobKeeper fortnights starting 28 September 2020 and 12 October 2020 only, employers will have until 31 October 2020 to meet the wage condition for all employees included in the JobKeeper scheme.

Business Participants

For eligible business participants (self-employed), the test to determine which rate to apply will instead be based on the assessment of the hours that the business participant was actively engaged in the business or undertaking specific tasks in business development and planning, regulatory compliance, or similar activities in an applicable reference period.

The reference period for business participants will be February 2020.

Please contact the office for any queries around eligibility or clarity with the new changes.

.png)

.png)

.png)