.png)

Paying super when you are self-employed

Being self-employed can be one of the most liberating decisions you’ve ever made.

It gives you the opportunity to grow in your field and the autonomy to work on your own terms. But no doubt you’ve also realised that a big part of working for yourself means learning how to handle all the other parts of being self-employed, like your superannuation – which can often feel complex, especially if you’ve only ever had someone else doing it for you (like an employer).

Just like all the other bits of your business that may have been overwhelming at some point, you’re about to get good at this one, too. And you’re about to do it in just 3 steps: save, contribute, and claim.

Step 1 - Save

What is the point of having super?

The short answer: Having dollars in the bank when you can no longer work means you can stay in control.

However, what no one really teaches you, is that your superannuation isn’t just about having money when you’re old. It’s also about being smart with your business and personal finances every year.

Even if you’re ‘not a numbers person’, you still know that saving money can pay off really well. But regardless of this knowledge, it can often be a struggle to prioritise ‘today’s money’ for your future self. So if you’ve been putting off your super for a while, you’re not the only one who’s been standing in their own way. Even if you start by setting up a direct debit to save just $10 a week – you’ll quickly rewire your brain to put your Future Self front and centre today.

Then, as you work out more accurately how much super to pay yourself, you can increase the weekly amount and it won’t feel as painful parting with that money. Even small, incremental amounts can make a huge difference by the time you reach retirement age. Or, stashing away slightly more each week could mean you retire earlier than you thought.

Step 2 - Contribute

This can often feel like a big hurdle for self-employed folks who feel like their work is either feast or famine. And because money gets locked up inside super straight away when you’re an employee, we’ve been conditioned the same should be true when we go out on our own. But you’ve got the advantage of flexibility.

One way around saving for super with a fluctuating income is to give yourself a bit of a buffer by setting up a separate bank account dedicated solely to your retirement savings. Think about it. If you’ve got all your money sloshing around in the one bank account, it’s very hard for your brain to separate one dollar from the next. But if you set up a special bank account for your retirement savings it can help you:

- Save more money because your mind treats that money differently (each dollar has a specific purpose).

- Have access to a stash of money just in case an emergency comes up or your income dips drastically.

- Actually transfer that money over to your super when it’s time (again, each dollar has a specific purpose so you’re less likely to spend it on something else).

Once again, you’re in control and on your way to a cushy stash that’ll be waiting for you when you retire.

Step 3 - Claim

Lots of people are totally unaware that you can use super contributions to reduce your taxable income. Which is a shame, because most of us feel like we pay too much tax anyway and we’d love a way to cut it down.

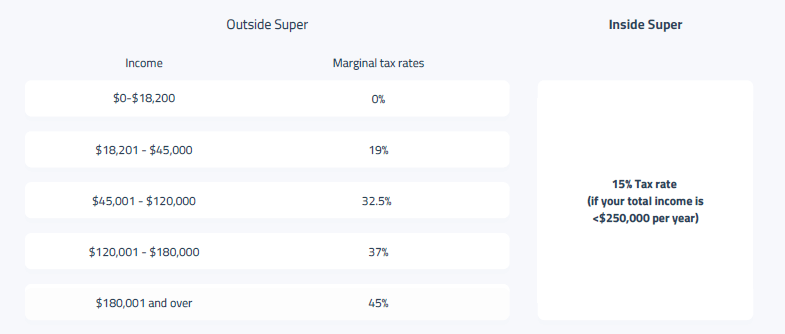

The government knows that locking money away for a really long time probably isn’t most people’s preference. So they incentivise us all to do it by giving us fiercely low tax rates inside super.

So you see, money made from earnings that's put inside super is taxed at 15%, versus outside of super where it's taxed at your marginal tax rate.

However, when you’re self-employed and making personal contributions, it’s really important to note that if you want the earnings you contribute to super to be taxed at 15% instead of your marginal tax rate, you have to claim your contribution as a tax deduction.

So how do you actually claim your personal contributions as a tax deduction?

Here’s the way to do it with most funds:

- Make the contribution

- Print off a Notice of Intent to Claim form

- Complete the form

- Send it to the fund

- Wait for the fund to process it

- Receive confirmation from the fund

- Use that receipt when you do your taxes.

Check if you’re eligible for the Government Co-contribution

Another thing that can feel like a hurdle to paying yourself super when you’re self-employed, is the feeling that you don’t earn enough

money yet to put any inside super. But that’s probably because nobody told you that there’s a way to get the government to put up to an

extra $500 into your super account every year if you’re a low income earner and you make some personal contributions into super.

That’s right – if you’re earning less than $54,837 (in FY21) and you contribute some money to super, you can get the government to also chip in too.

Known as the Government Co-contribution, this benefit helps low income earners build up their super. And the great news for all the busy self-employed peeps out there is that there’s no paperwork involved with these cocontributions.

If you’re eligible, any Government top-ups are automatically credited to your super account once you’ve done your tax return in the year in which you made the contribution. (As long as you haven’t already claimed those contributions as a tax deduction).

The Money Edge | Bundaberg

.png)

.png)

.png)